Can a Financial Crisis Happen Again

The South Sea Bubble has been called: the earth'southward first financial crash, the world's first Ponzi scheme, speculation mania and a disastrous example of what can happen when people fall prey to 'grouping retrieve'. That it was a catastrophic financial crash is in no dubiety and that some of the greatest thinkers at the time succumbed to it, including Isaac Newton himself, is also irrefutable. Estimates vary just Newton reportedly lost as much as £xl million of today'south coin in the scheme. But what actually happened?

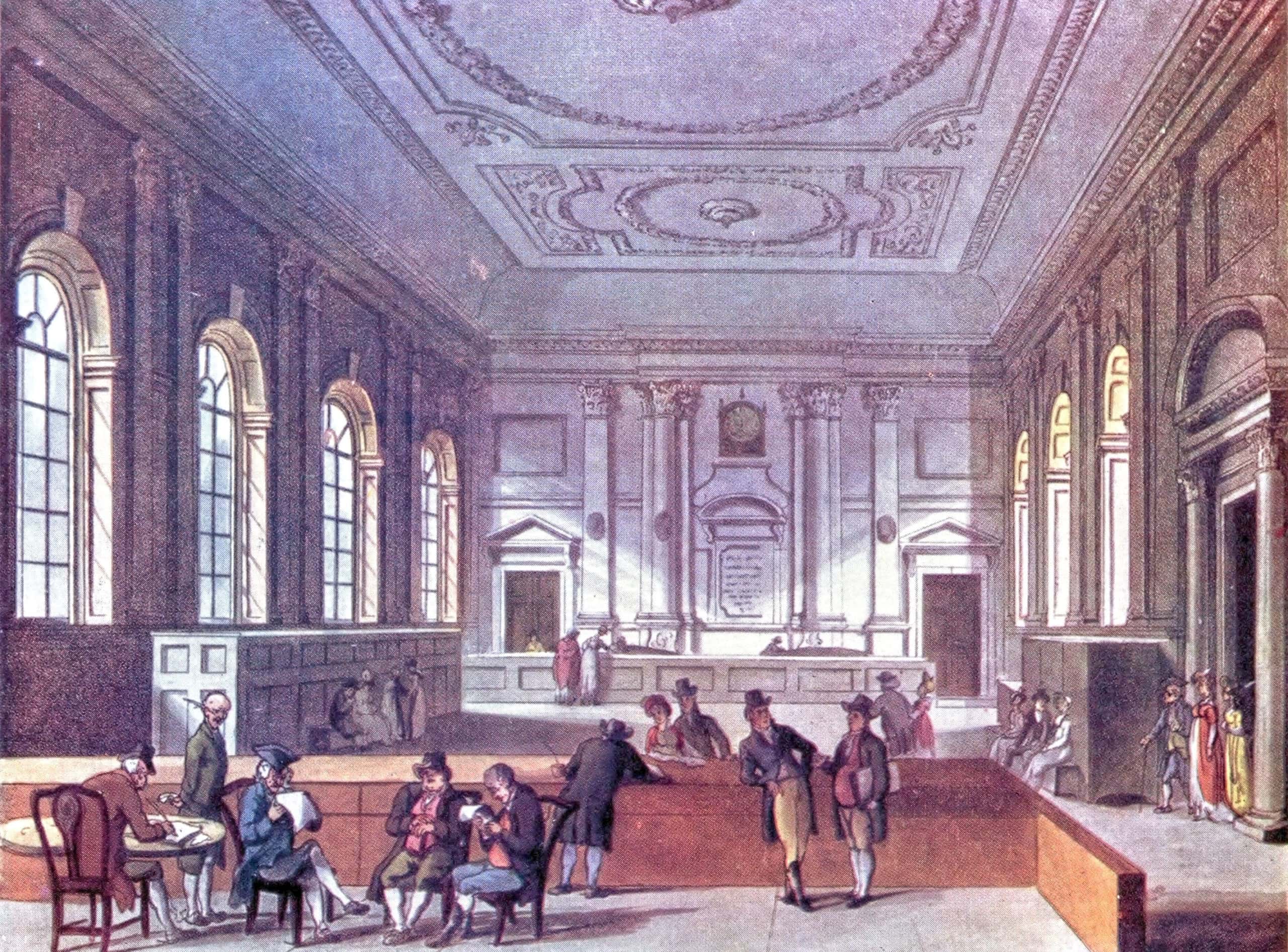

Information technology all began when a British joint stock visitor called 'The South Sea Company' was founded in 1711 by an Act of Parliament. Information technology was a public and private partnership that was designed every bit a way of consolidating, controlling and reducing the national debt and to assistance Britain increase its trade and profits in the Americas. To enable it to do this, in 1713 it was granted a trading monopoly in the region. Part of this was the asiento, which allowed for the trading of African slaves to the Castilian and Portuguese Empires. The slave merchandise had proved immensely profitable in the previous ii centuries and there was huge public confidence in the scheme, as many expected slave profits to increase dramatically, especially when the War of the Spanish Succession came to an finish and merchandise could brainstorm in earnest. It didn't quite play out similar that however…

The South Sea Company began by offering those who bought stocks an incredible 6% interest. Notwithstanding, when the War of the Spanish Succession came to an stop in 1713 with the Treaty of Utrecht, the expected merchandise explosion did not happen. Instead, Kingdom of spain only allowed Britain a express amount of merchandise and even took a percentage of the profits. Kingdom of spain also taxed the importation of slaves and put strict limits on the numbers of ships Britain could send for 'general trade', which ended up being a single ship per year. This was unlikely to generate anywhere close to the profit that the South Sea Company needed to sustain information technology.

Yet, King George himself and then took governorship of the company in 1718. This farther inflated the stock as nil instils conviction quite like the endorsement of the ruling monarch. Incredibly, before long later on stocks were returning ane hundred per centum interest. This is where the bubble began to wobble, as the company itself was non actually making anywhere near the profits information technology had promised. Instead, information technology was simply trading in increasing amounts of its own stock. Those involved in the visitor began encouraging – and in some cases bribing – their friends to buy stock to farther inflate the price and go along demand high.

And then, in 1720, parliament immune the South Bounding main Company to take over the national Debt. The visitor purchased the £32 million national debt at the cost of £seven.five million. The purchase besides came with assurances that interest on the debt would be kept low. The idea was the company would employ the money generated by the e'er-increasing stock sales to pay the interest on the debt. Or amend nonetheless, swap the stocks for the debt interest directly. Stocks sold well and in plough generated higher and higher interest, pushing up the price and demand for stocks. By August 1720 the stock toll striking an heart-watering £1000. It was a cocky-perpetuating cycle, but as such, lacked any meaningful fundamentals. The trade had never materialised, and in turn the company was just trading itself against the debt that it had bought.

So in September of 1720, some would say an inevitable disaster struck. The bubble burst. Stocks plummeted, downward to a paltry £124 by December, losing 80% of their value at their height. Investors were ruined, people lost thousands, there was a marked increase in suicides and at that place was widespread acrimony and discontent in the streets of London with the public demanding an explanation. However, even Newton himself couldn't explain the 'mania' or 'hysteria' that had overcome the populous. Mayhap he should have remembered his apple tree. The House of Commons, wisely, chosen for an investigation and when the sheer calibration of the abuse and bribery was unearthed, it became a parliamentary and financial scandal. Non everyone had succumbed to the 'group think' or 'speculation mania' all the same. A vociferous pamphleteer by the proper noun of Archibald Hutcheson had been extremely critical of the scheme from the beginning. He had placed the actual value of the stock at around £200, which subsequently turned out to be nigh right.

The person that came to the fore to sort out the result was none other than Robert Walpole. He was made Chancellor of the Exchequer and there is no uncertainty that his handling of the crunch contributed to his rise to power. In an effort to forbid an effect such every bit this from happening once more, the Bubble Act was passed by parliament in 1720. This forbade the creation of articulation-stock companies such equally the South Sea Visitor without the specific permission of a royal charter. Somewhat incredibly, the company itself persisted in trading until 1853, albeit after a restructuring. During the 'bubble' around 200 'bubble' companies had been created, and whilst many of them were scams, non all were nefarious. The Imperial Exchange and London Assurance survive to this very day.

Today, there are many commentators drawing comparisons betwixt 'Cryptocurrency mania' and the Due south Body of water Bubble, and annotation that, 'promoters of the Bubble made impossible promises.' Perhaps historians of the future will take cause to look dorsum with like incredulity on today'south market. Only time will tell.

"Bubbles, bright every bit ever Hope

Drew from fancy – or from lather;

Bright every bit e'er the South Sea sent

From its frothy element!…

Run across!—Simply hark my time is out —

Now, like some great h2o-spout,

Scaterr'd past the cannon's thunder,

Burst, ye bubbling, outburst asunder!"— Thomas Moore

Source: https://www.historic-uk.com/HistoryUK/HistoryofEngland/South-Sea-Bubble/

0 Response to "Can a Financial Crisis Happen Again"

Post a Comment